The Future of Business Banking for SMEs

This white paper is designed for banks seeking to prioritise digital transformation and customer experience (CX) for SMEs

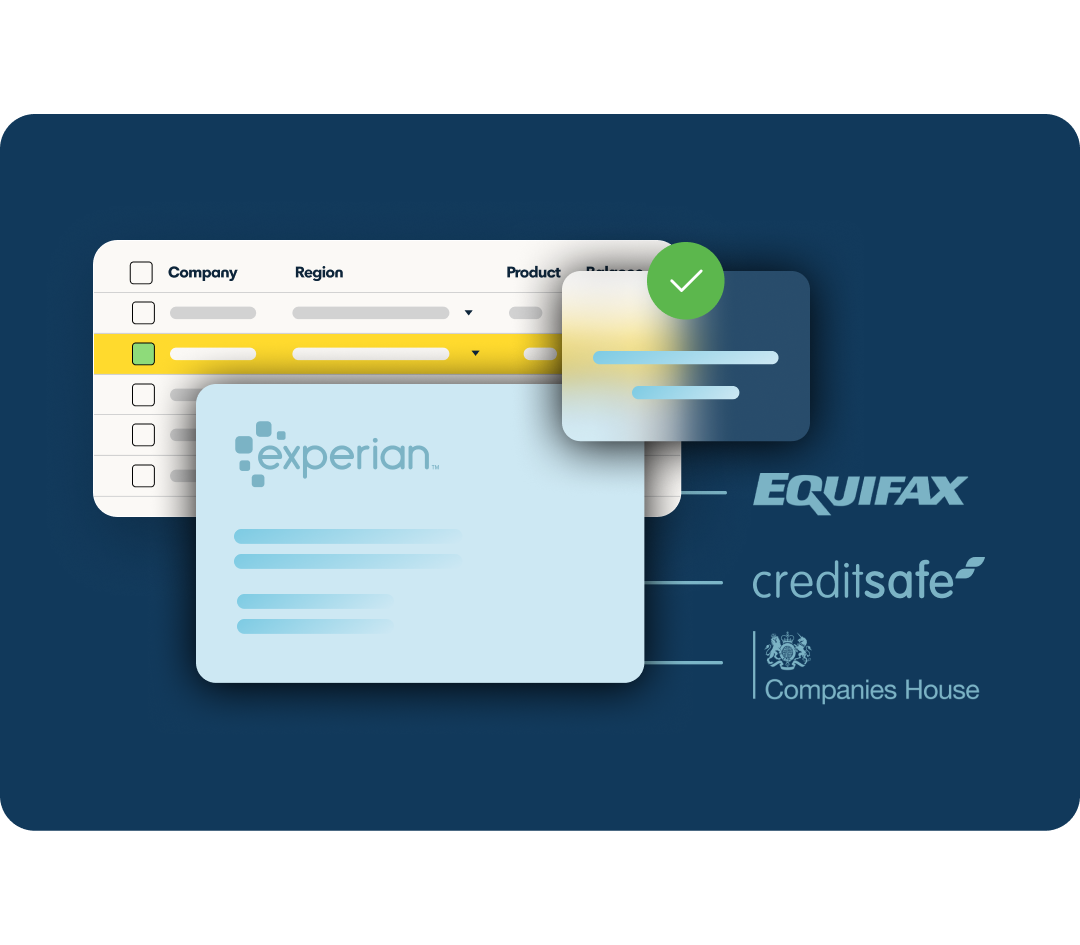

nCino Onboarding eliminates disconnected, manual processes with integrated, automated workflows on a unified platform to achieve transparency and compliance. With access to 270 million + connections, including Equifax, CreditSafe, and Companies House, onboard smarter with enhanced intelligence and automation.

More than 450+ clients, with 90% from regulated industries trust FullCircl to onboard smarter. By integrating with nCino to create a unified onboarding solution, we're helping you solve the most complex challenges banks face when onboarding customers.

Regulatory & Operational Complexity

average onboarding time for commercial customers due to regulation and complexity

(McKinsey & Company).

Escalating Risks of Financial

Crime & Fraud

cost of financial crime compliance in across all Financial institution in EMEA in 2023. This expenditure was the highest globally (Forrester Consulting).

Rising Customer Expectations

lost clients due to slow & complex onboarding (KYC Trends Report).

nCino Onboarding addresses these challenges by:

Accelerating Revenue

Expedite revenue generation with faster client activation, deal closure and early cross-selling opportunities

Proactively Monitoring Risk

Continuous risk monitoring throughout client lifecycle

Unifying the Onboarding Experience

Complete process visibility from a single source of truth

Providing Real-time Verification

KYC, AML, and business data validation, Minimize manual intervention

Simplifying Compliance

Streamlined document collection, validation, and compliance reporting

Integrating Data

270m+ connection unified in one platform for seamless data orchestration

Financial institutions who implemented nCino onboarding have experienced

reduction in onboarding time

minute business account opening

reduction in data entry and manual input time

more critical risk issues identified for enhanced security and compliance

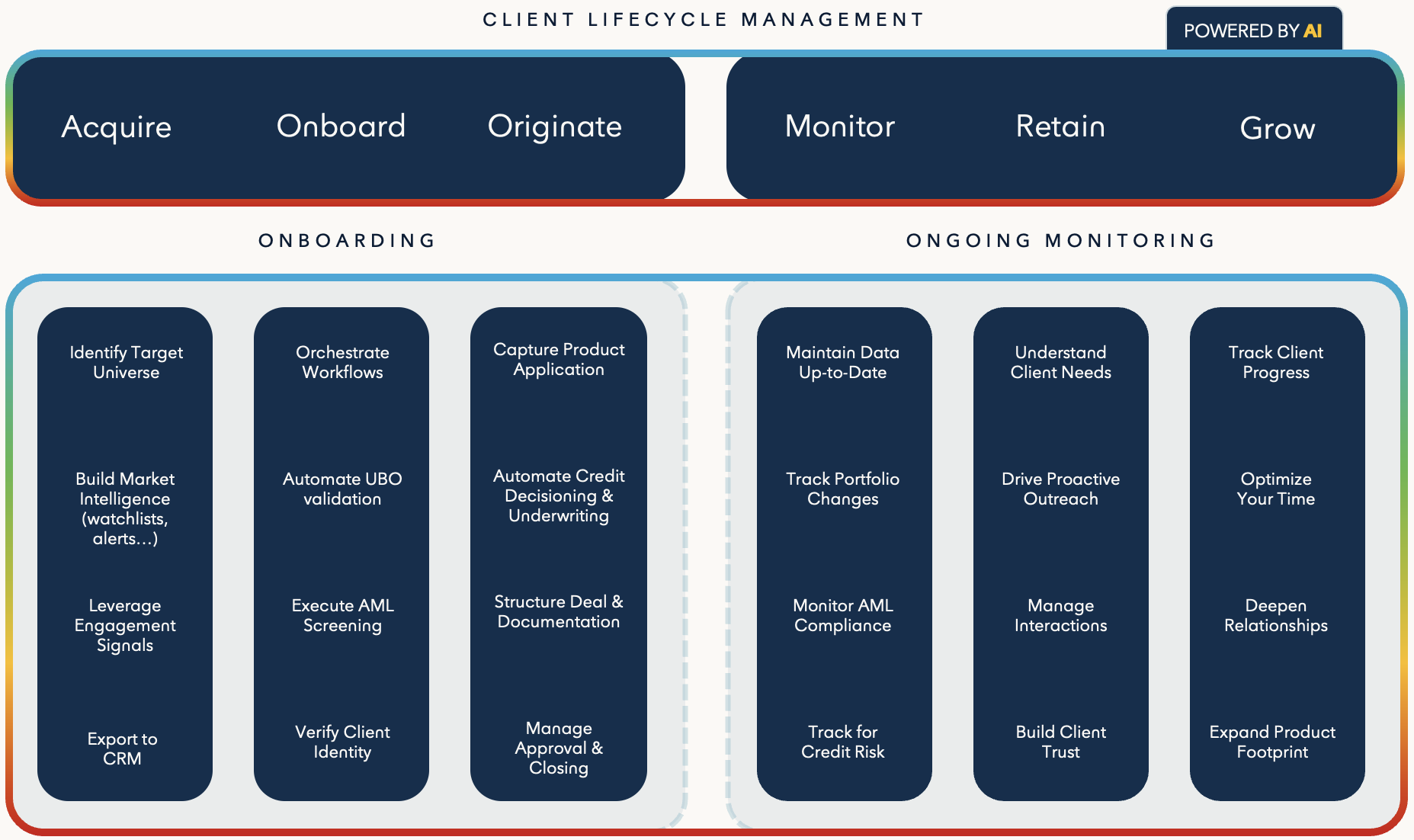

For enhanced client lifecycle management

We are excited to take such a revolutionary tech-driven approach to bringing compliance and KYC into the forefront of our business and commercial banking activities."

Mark Stokes

Fmr. Managing Director, Commercial Banking at Metro Bank

Since partnering with us, Metro Bank have:

The chief advantage for the onboarding team of using third-party insights has been efficiency. Whereas before they relied on manual data gathering, either via Companies House, creating reports or having clients fill in forms, they can now pull the information they need instantly and verify it."

Katie Ives

Head of Digital Onboarding, Santander UK

Since partnering with us, Santander UK have:

The project has delivered significant enhancements to our systems and processes that not only smooth the overall funding process, but also give greater transparency to borrowers and their advisers. Our partnerships with nCino and FullCircl have allowed us to exceed our initial requirements and improve day-to-day use of the platform, delivering large meaningful change more quickly than we had originally anticipated.”

Liam Murphy

Head of Change, Thincats

Since partnering with us, ThinCats have:

Delivering enhanced client lifecycle management

The leading provider of 3rd party data services and orchestration for customer identity, validation, AML, KYC, KMB, Risk & Fraud Detection

Trusted by 450+ clients, with 90% from regulated industries

Access to 270M+ connections providing up-to-date insight on international companies